Willow oil production would lead to lower state revenues for years because of state oil tax law

You would never guess it from reading the resolutions and declarations of support about the Willow project from Alaska politicians and businesses, but development of the oil field would cost the state hundreds of millions a year during the early years of construction and production.

That’s because it is on federal land and the state would collect no oil royalties from the field, only production taxes.

Equally important, a benefit to oil companies in state law allows ConocoPhillips to write off the expense of developing Willow against its other operations in Alaska immediately, reducing how much it pays in taxes for up to eight years.

The state doesn’t have to provide this benefit, but the oil industry likes it this way for obvious reasons and most of Alaska’s elected officials—starting with Gov. Mike Dunleavy—won’t challenge the status quo.

“The oil executives operating our legacy fields — Prudhoe Bay, Kuparuk, and Alpine — deduct from our legacy fields’ revenue spending on land not owned by Alaska,” is how former Sen. Joe Paskvan put it in 2020, estimating the cost to the state at $250 million to $300 million a year from the Willow project.

So-called “ring fencing” that limited the ability of a company to transfer costs to reduce taxes this way was part of Alaska’s oil tax system until 2006 and would have been reinstated under the oil tax initiative rejected by voters in 2020.

If the Willow project is approved by the Biden administration and the oil company proceeds with construction, state revenues will decline, not increase, during the early years of development.

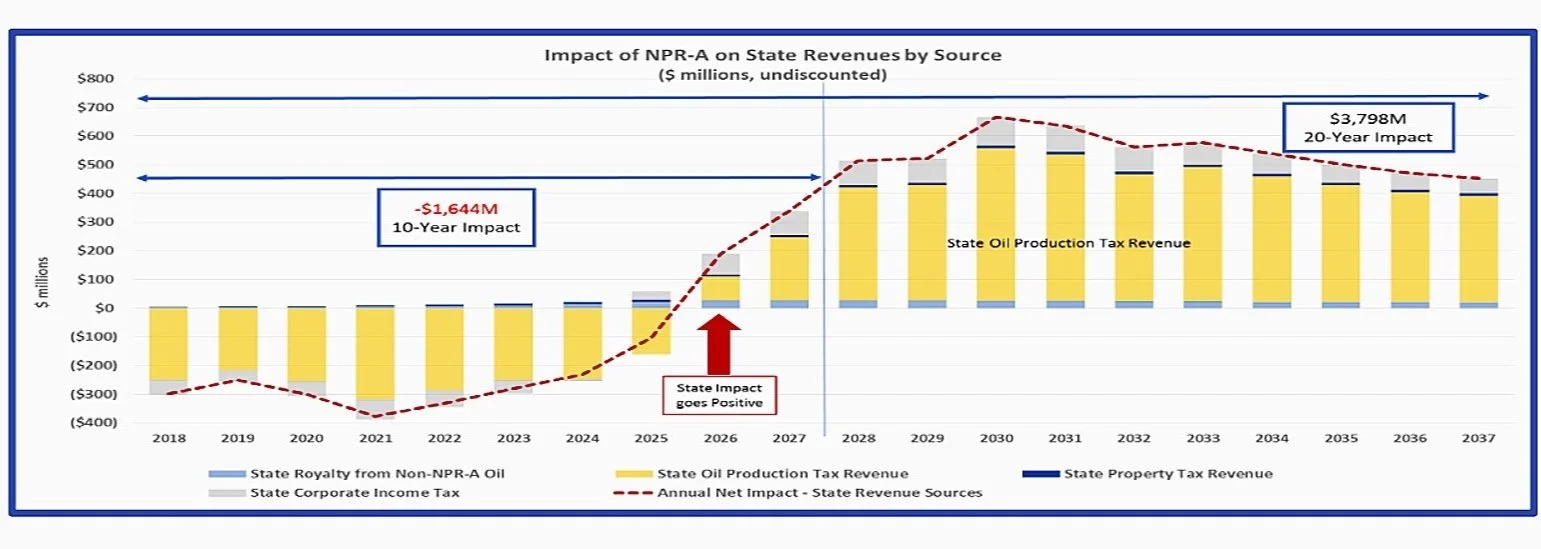

A 2018 analysis said that over a decade the loss would be about $1.6 billion in 2018 dollars. The situation would turn around once the project is built and the write-offs decline. The chart below, based on the idea that Willow would be online in 2024-2025, says there would be a positive state revenue impact by 2026.

The delays in developing the project would mean that the positive impact might not come until 2030 or later. One analysis put the 20-year positive impact at $5 billion to $9 billion without adjusting for inflation.

One of the quirks in this situation is that if oil prices are say $60 per barrel, the short-term negative impact on the state treasury would be reduced because ConocoPhillips would not be able to write off the Willow expenses immediately. The write-offs would be delayed. But if oil is priced at $75, the company would be able to write off the costs immediately and state income would be lower.

The state estimated in 2018 that oil development on the NPR-A would cost the state $1.6 billion over a decade in reduced taxes because the state oil tax system allows the expenses to be written off immediately against other production in Alaska.

Half of NPR-A royalties go to the federal government, while half go to the state with strings attached. The attached strings, established by law and court rulings, are that the state give priority in disbursing the money to the local governments with the most direct impact from oil and gas development—a provision interpreted to mean communities in the North Slope Borough.

The 50 percent share of Willow royalties would translate into a major benefit, perhaps $150 million a year, to the North Slope communities, according to this 2019 state estimate.

With this direct financial stake, it is no surprise that the North Slope Borough is lobbying hard for the project, allied with the oil industry and most Alaska politicians. Sen. Dan Sullivan is claiming that opposition to the project by the Biden administration is racist.

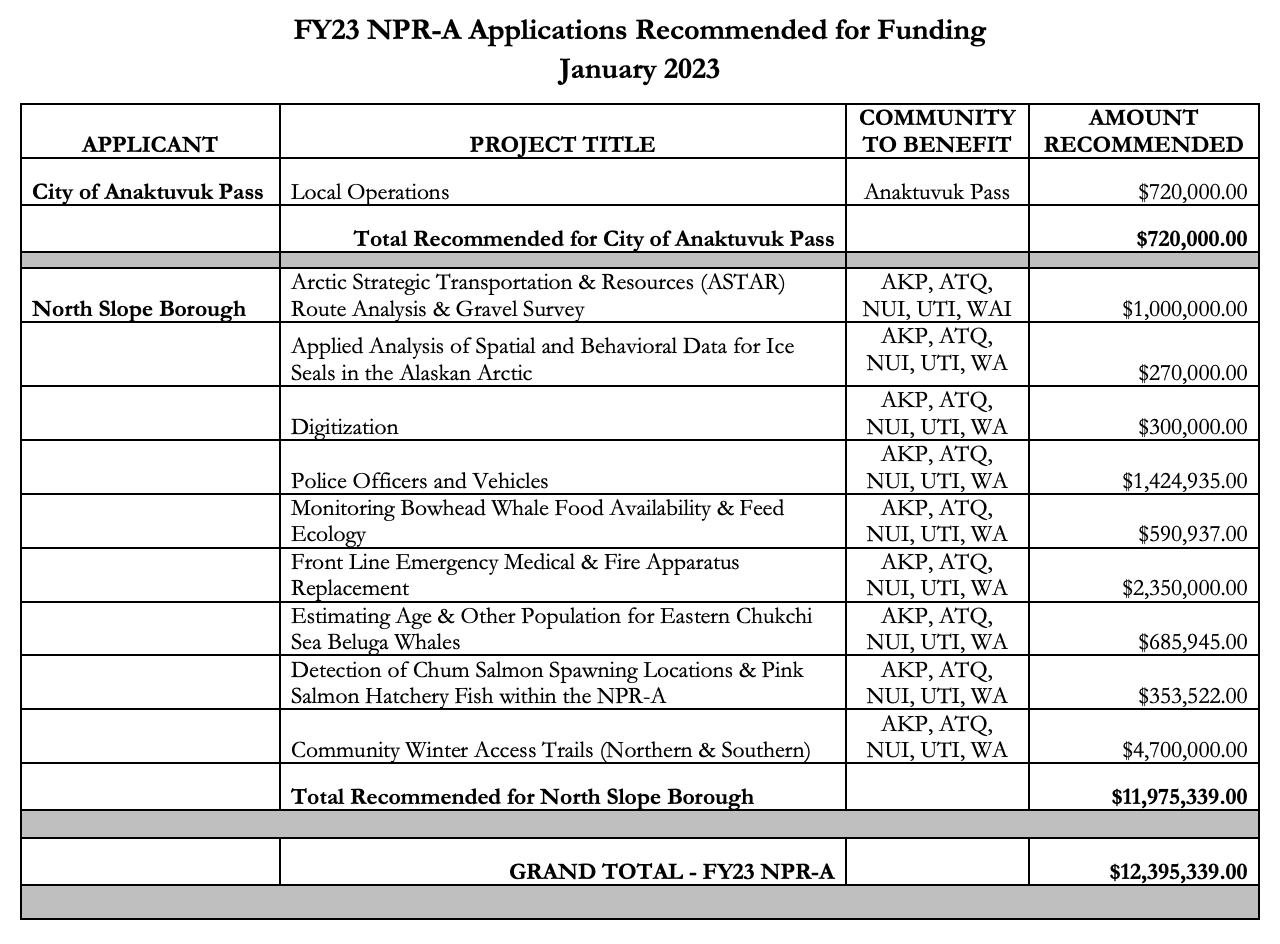

Grants have gone to Utgiagvik, Nuiqsut, Wainwright, Atqasuk, Anaktuvuk Pass and the North Slope Borough.

From the existing relatively small amount of NPR-A royalties now being paid, the communities have applied for about $12 million in grants for this fiscal year. The amounts have varied widely over the years because of lease sale results, rents, bonuses and royalty payments,

The grants would cover everything from public safety and ice studies to whale research and winter trail construction. Here is the latest annual report on the program.

Over the last quarter-century, about $200 million in grants have been distributed to the villages and the borough. The total was more than $150 million as of 2016.

For full details on the revenue impact of the proposed Willow development, here is the 2018 white paper that covers the subject in detail.

On Jan. 17, 2019, the Senate Finance Committee received a briefing on the NPR-A proposals and the financial impact on the state.

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-0673