Dunleavy wants to eliminate all corporate income taxes in Alaska, a giveaway that would soon top a half-billion a year

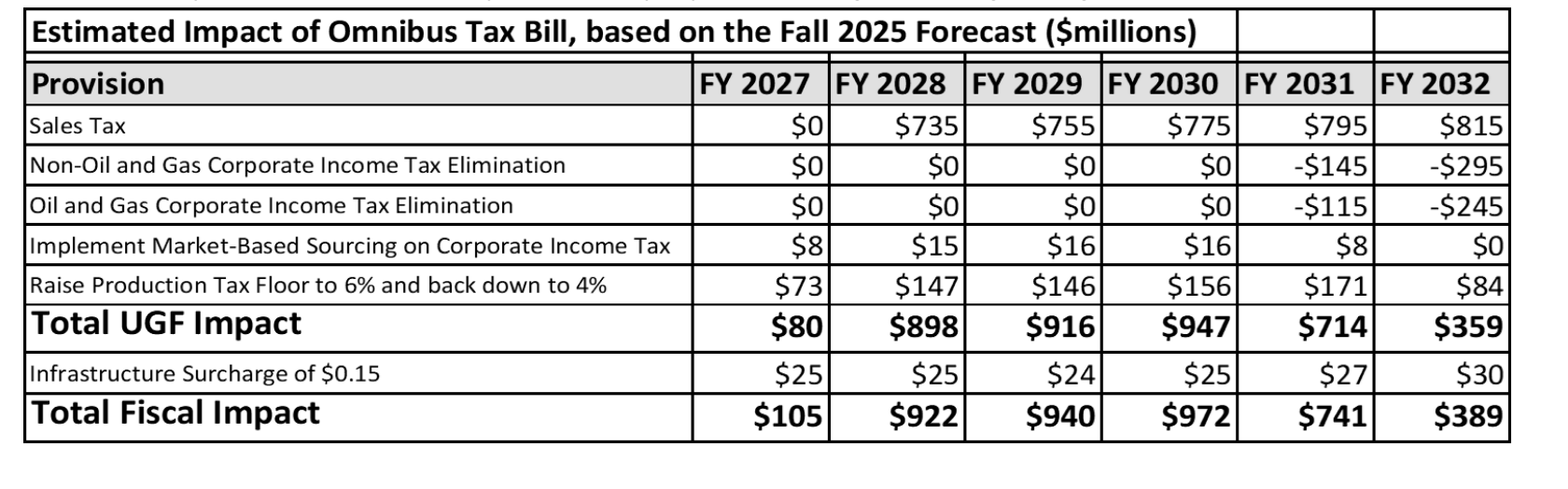

Hidden in the governor’s plan to enact a statewide sales tax is a plan to eliminate all corporate income taxes in Alaska in five years, which would cost the state more than a half-billion dollars a year starting in mid-2031.

Gov. Mike Dunleavy has made no case in public for the elimination of the petroleum corporate income tax—expected to generate $245 million a year—or the corporate income tax, which could otherwise be generating nearly $300 million a year in five years.

Eliminating the oil company income tax—which would largely benefit a small number of companies topped by ConocoPhillips, ExxonMobil, Santos and Repsol—would reduce state revenue by $360 million in 2031-2032, the state guesses.

After that it would cost the state about $250 million a year. It’s a Golden Age in Alaska for the oil companies under Dunleavy, who will sell this as a permanent tax break to the industry in exchange for some temporary pain.

Here is the fiscal note for Senate Bill 227. Here is the bill, which was introduced Monday. It is a dense 56-page assemblage of changes in the law that will not be clear to the reading public.

Dunleavy and his crew have failed to provide detailed explanations in English about what they are doing and why he did not involve the public in the process.

Instead of closing the Hilcorp loophole—which subtracts about $100 million a year from state corporate income tax revenue because the state failed to adapt its laws after billionaire Jeff Hildebrand bought out BP—Dunleavy wants to extend the loophole to all oil companies in Alaska.

A bill to close the Hilcorp loophole remains possible in the state Senate, where Democratic gubernatorial candidate Matt Claman has been a roadblock. He has given a variety of reasons for his opposition. None of them are reasonable.

Closing the Hilcorp loophole is the easiest oil tax vote in the history of oil tax votes. Even Dunleavy supported it in 2021, though he now claims otherwise.

Dunleavy’s generosity to the oil industry on his way out the door appears to be an attempt to buy support for temporarily raising the minimum oil tax. The deal is heavily weighted in favor of the industry.

He is holding out the promise of a future permanent tax break if the companies go along with the notion of raising the minimum gross tax from 4 percent to 6 percent from 2027 to 2031.

The higher gross minimum oil tax would cost the industry about $787 million from 2027 to 2032, the revenue department guesses.

Eliminating the oil company income tax, however, would give the industry a benefit of $250 million a year for as long as the companies are in business here. By 2035, the companies would have long since made up more than the extra temporary taxes.

This proposed giveaway is a bad deal for Alaska. And it’s no wonder that Dunleavy has kept this secret.

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-0673.