Dunleavy, who claimed he wanted a 'seasonal' sales tax, proposes year-round tax that doubles in the summer

Gov. Mike Dunleavy claimed last week he would propose a “seasonal” sales tax.

"There will be a temporary, seasonal sales tax concept put forth for discussion with the Legislature," Dunleavy said during a cabinet meeting last week.

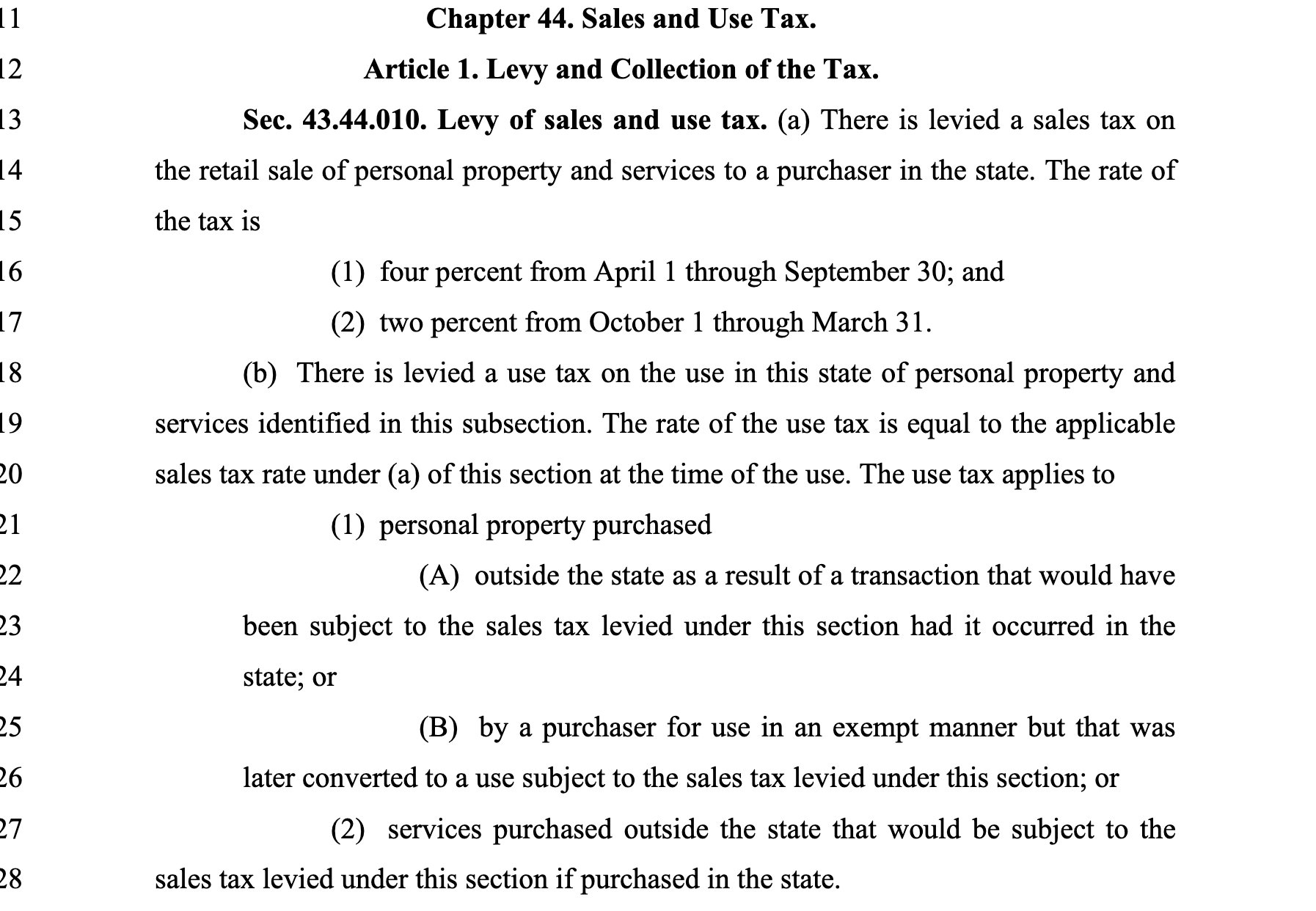

But he is not proposing a seasonal sales tax. He introduced a bill today for a year-round 2 percent tax, doubling to four percent between April and September.

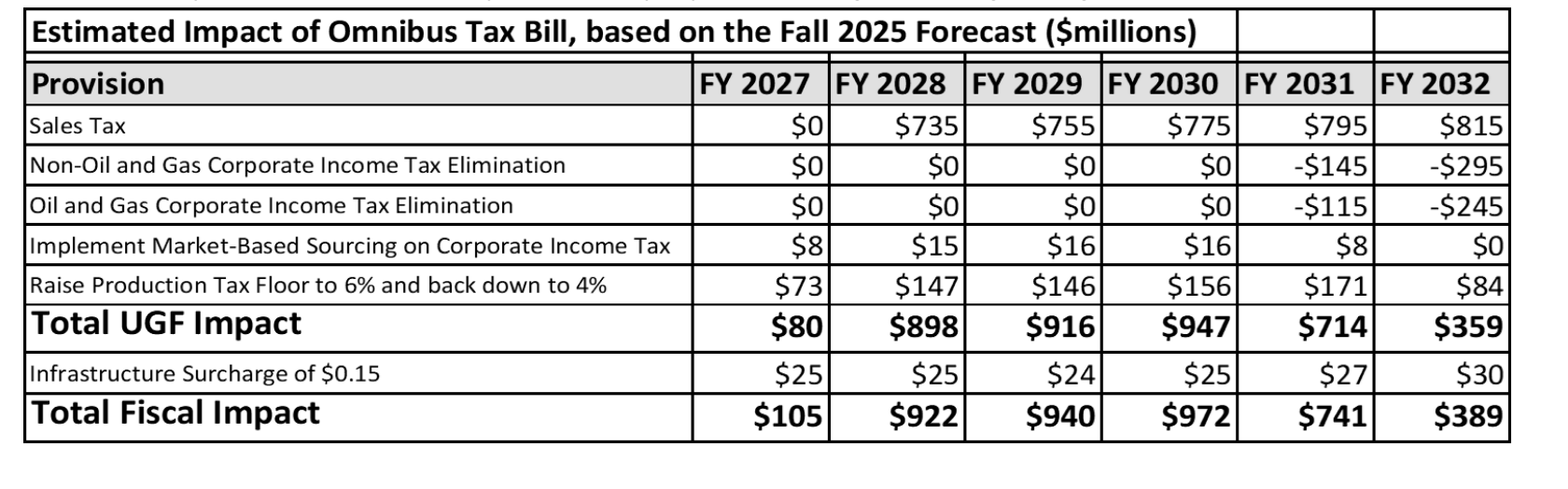

Dunleavy was either lying or uninformed about his proposal, which the state says would collect $735 million a year. The state would have to hire 67 new employees to handle the tax.

“The state sales and use tax would apply at a rate of four percent from April through September and two percent from October through March on retail sales. While local governments retain the authority to levy sales and use taxes, the Department of Revenue would administer and collect the tax to streamline the process for taxpayers—remitting the local taxes collected to the local governments,” the revenue department says.

“Boroughs and cities retain the ability to administer excise taxes on items such as lodging, car rentals, alcohol, tobacco, fuel, fish, and marijuana. The bill provides exemptions for government purchases, food assistance programs, wages, health care services, insurance premiums, certain real property transactions, and other limited categories such as isolated or occasional sales.”

He is also proposing raising the minimum oil tax from 4 percent to 6 percent and a host of other tax changes, including a 15-cent per barrel surcharge on oil in the pipeline to pay for road maintenance. This would be about $25 million a year.

The oil tax increase would add about $147 million a year for a while.

He is also proposing eliminating the general corporate income tax in 2031, which would cost the state $295 million a year in 2032. And cutting the oil company corporate income tax would cost $245 million a year.

This package is not a fiscal plan. It is a disaster.

Stuffing all of these items into one so-called omnibus bill, with specifics that have had no public review, is added evidence that Dunleavy is not serious.

The bill will not pass this year, though elements of it make sense, including raising the minimum oil tax and establishing a statewide tax of some kind.

All of the tax changes would be conditional upon passage of an unworkable spending limit of 1 percent and a Permanent Fund constitutional amendment. Those are not going to pass either.

He wants to be able to claim during his last year in office that he tried to do something about the state’s financial problems. But this half-hearted effort is doomed.

Here is the fiscal note that examines each element of the bill.

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-0673.