Dunleavy's projected deficit swells as oil prices crater

Gov. Mike Dunleavy needs to admit that the state’s financial plight during the opening months of the “Golden Age of Alaska” is far worse than the Alaska Department of Revenue guessed in March.

Falling oil prices are swelling the proposed Dunleavy deficit by the day, now closing in on $2 billion.

It turns out that the moronic chant of “energy dominance” and the endless babbling of “Drill Baby Drill” don’t mean what the followers of Trump have been led to believe.

Saudi Arabia has started a drill baby drill price war.

“In a meeting abruptly rescheduled two days early, the Saudi Arabia-led Organization of Petroleum Exporting Countries announced Saturday it would boost its production quota. The move marks the third straight monthly increase, placing the global oil industry on price-war footing,” Investors Business Daily said.

Guessing oil prices may be easier than guessing the right minute that the ice will go out in Nenana, but it’s almost impossible to get it exactly right.

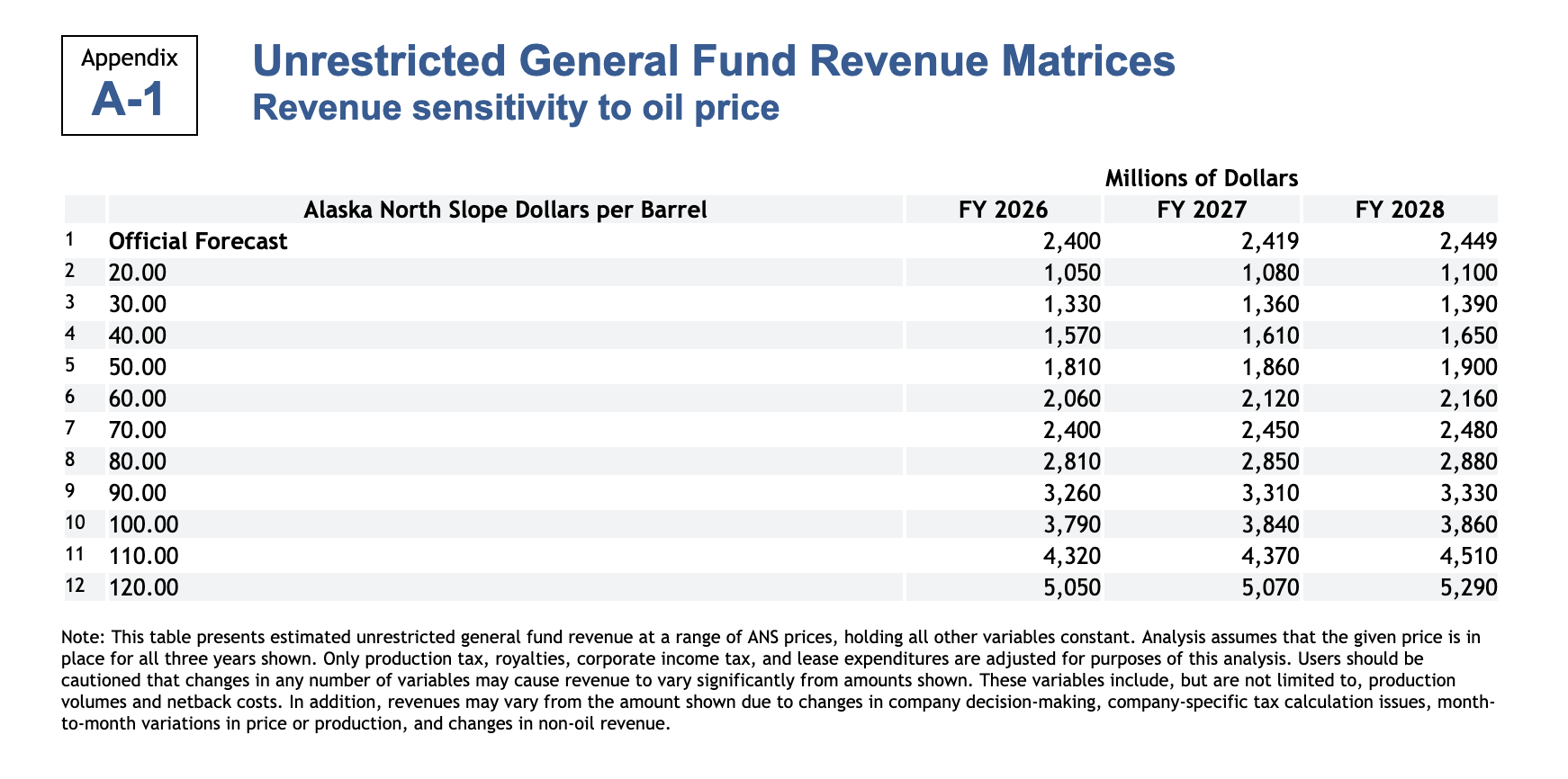

In March, the state guessed that oil prices for the fiscal year starting in July would be $68 a barrel. This was down from the December guess of $70 a barrel. Every dollar decrease means something like a $40 million cut in revenue over a year’s time.

Goldman Sachs is now guessing that crude prices will be $60 or lower this year and next year, which would add hundreds of millions to the state deficit.

It’s time for a new guessbook.

I don’t think this is what Dunleavy meant when he said that every day is like Christmas under Trump.

This chart is from the December revenue guessbook, which said the price of oil in the next fiscal year would be $70 a barrel, with oil revenues of $2.4 billion. The oil futures market is now closer to $60 a barrel, however, which would increase the state deficit by $340 million or so.