Tetlin mine stands out as one of the world's highest grade open pit gold mines

The proposed Tetlin mine would be among the highest grade open pit gold mines in the world, if not the highest, according to Rick Van Nieuwenhuyse, the geologist and mine promoter who sold the idea to Kinross of trucking the ore nearly 250 miles across Interior Alaska to Fort Knox.

The ore is now expected to produce twice as much gold per ton as estimated in 2018 when a study said the capital costs of building mine processing facilities at Tetlin could be recovered in two years of mining. The after-tax internal rate of return was estimated at 29 percent with a grade of 4 grams per ton.

The Tetlin ore is now expected to contain 8 grams of gold per ton, more than 10 times the grade of the ore mined at Fort Knox by Kinross. On occasion Van Nieuwenhuyse has said the grade is 15 times richer than that of Fort Knox.

Van Nieuwenhuyse is CEO of Contango, which owns 30 percent of the joint venture. Kinross owns the rest, as well as the Fort Knox mine. Van Nieuwenhuyse’s total 2022 compensation from Contango, a company that has drawn a $10 million investment by the Alaska Permanent Fund, was $2.8 million.

The Alaska Permanent Fund owns 7.3 percent of Contango, making it the fourth largest shareholder, while Van Nieuwenhuyse, who has 9 percent, is third on the list.

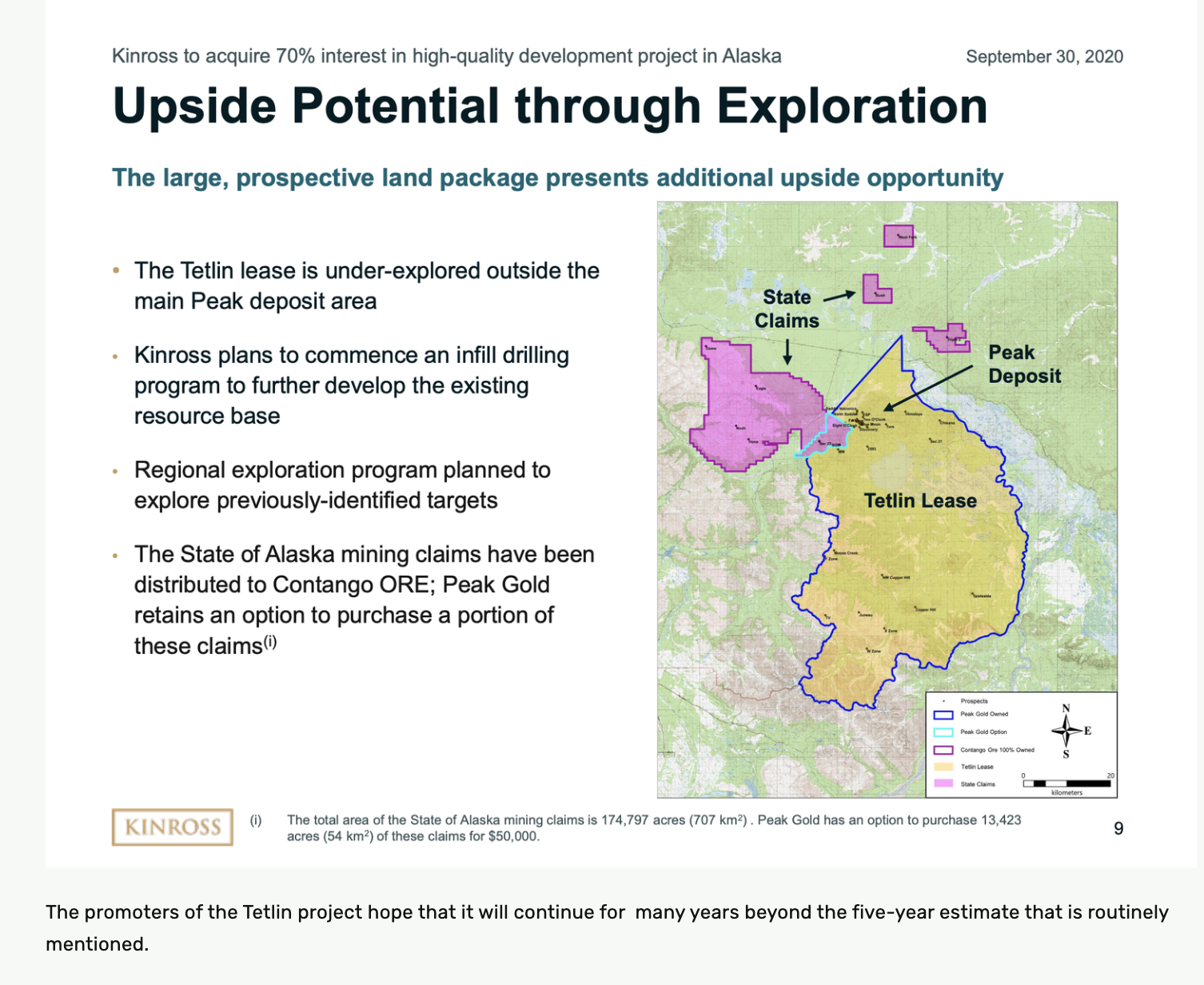

“I fully expect that we’ll have more than a five-year mine life,” he said in an interview last November in Zurich, mainly because Contango has an area to explore that is the size of Rhode Island, owned by the Tetlin tribe.

The Tetlin mine site is about 10 miles south of Tok.

In 2018, when the estimated gold recovery from the Tetlin project was estimated at only 4 grams per ton, a preliminary economic assessment found that building a mill at Tetlin would be very profitable.

Here is the 2018 press release promoting the “robust open pit mining operation with attractive economics” and a 3,500 ton-per-day processing facility at Tetlin.

“The robust economic returns are a result of the deposit’s high grade, low strip ratio, shallow depth of the resource, and access to infrastructure. Establishing an economic project in the Peak area is a great start to realizing the ultimate value of Peak Gold’s assets, which include a large acreage position outside of the Peak area with significant exploration potential,” said Brad Juneau, then the CEO of Contango ORE. He is now the chairman of Contango.

The project had an “after-tax payback period for initial development capital of approximately two years,” according to Royal Gold Inc. The company had a joint venture with Contango and sold its interest in the project to Kinross in 2020.

In January 2020, Van Nieuwenhuyse told the North of 60 Mining News that “There are few 4-gram-per-metric-ton, 1 million-ounce-plus gold deposits in an open-pit mining scenario anywhere in the world. So, to have one on a road system in Alaska – well, that's just awesome! I don't have to get a 200-mile-road or a 300-mile-gas pipeline built like at Ambler and Donlin. The Peak deposit just needs a driveway!”

Later that year, when Kinross bought 70 percent of the project, founded on the idea of trucking ore to Fort Knox, the Canadian company said it expected the ore to contain 6 grams of gold per ton, which would have represented a major improvement on the economics of building a facility in Tetlin at 4 grams per ton.

The company said the trucking plan would “drive attractive returns.” It said it would cost about $750 an ounce to produce gold. That estimate has since gone up sharply because of inflation and the need to buy its own trucks, but at today’s gold prices the expected profit is still close to $900 per ounce.

A year ago Kinross said it expected that the Tetlin ore would produce 8 grams per ton, or 10 times the amount produced per ton at Fort Knox.

This means that every ton of rock from Tetlin is now expected to contain twice as much gold as was assumed in the 2018 preliminary economic assessment about the high profit potential of on-site processing.

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-0673.