ISER updates research on fiscal options for Alaska

The institute of everything, as smart alecks used to called ISER when it had a longer name, ISEGR, and was based in Fairbanks, has a new report out about state financial options.

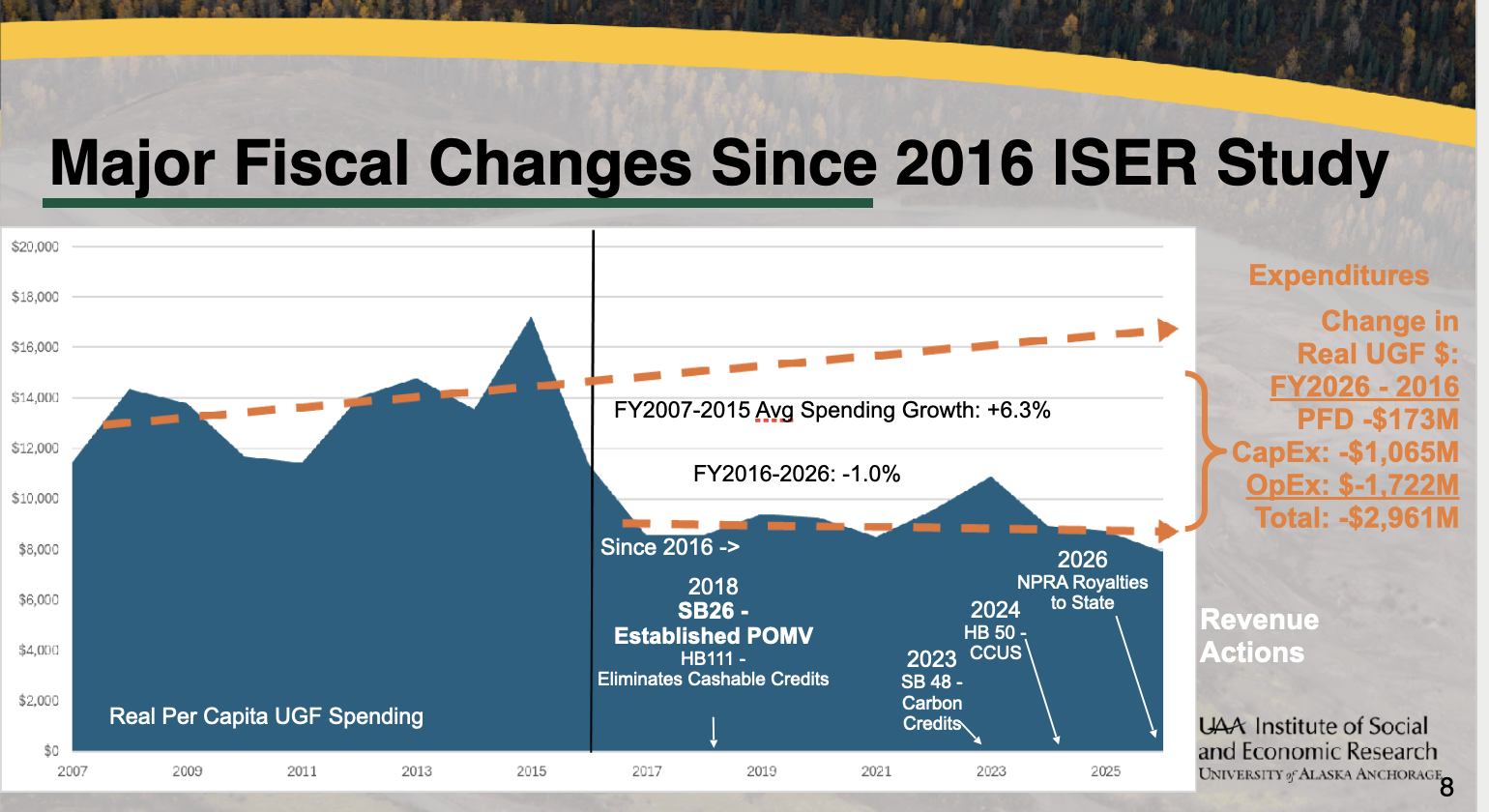

“ISER researchers evaluated 11 primary fiscal options + three variations. These included changes to state spending, broad based taxes, and businesses taxes. Nine of these options were selected to match those ISER evaluated in 2016. In addition, ISER modelled two new options related to business taxes. ISER also evaluated three variations of these options,” ISER said.

The Alaska Beacon has the best coverage.

“Raising business and oil taxes would have the lowest negative impact on jobs and income, while cuts to services would have the biggest negative effect on them,” the Beacon reported.

“Reducing the Permanent Fund dividend to balance the budget — which has been the existing legislative policy for the past several years — has similarly large negative effects on income, but smaller negative effects on employment. Poor Alaskans are affected more by a PFD reduction than rich Alaskans, making it the most regressive option,” the Beacon said of the report.

“Among statewide taxes, a progressive income tax would have the biggest negative impact on high-income Alaskans and the lowest negative impact on low-income residents.”

The big thing to know is that there ares lots of tradeoffs no matter what options are considered. ISER’s work was funded by the governor’s office, but the agency says that the source of the money did not influence the research or conclusions.

This is an incredibly complicated exercise that deals with math and human behavior. It will take some effort on the part of Alaskans to understand the range of options. The work will be important in advancing the discussion beyond where it is today.

Now that ISER has presented its findings, it can go back and simplify the presentation as much as possible without distorting the contents. This is important not just to communicate the contents for legislators, but for members of the public who have an interest in understanding public policy. It is a complex picture.

Our situation is not a simple one and we should beware of those with easy solutions, such as the candidates for statewide office who are counting on miracles.

I expect that researchers from the Institute of Social and Economic Research will refine their materials and their explanations so that the general public will have a better understanding of the tradeoffs.

Here is the video from Thursday in Juneau.

Here is the ISER website with background on the research.

“Alaskans would pay about 73% of the revenue raised from a narrow sales tax, with visitors, non-resident workers, and the federal government (through SALT deductions) paying the balance,” the report says.

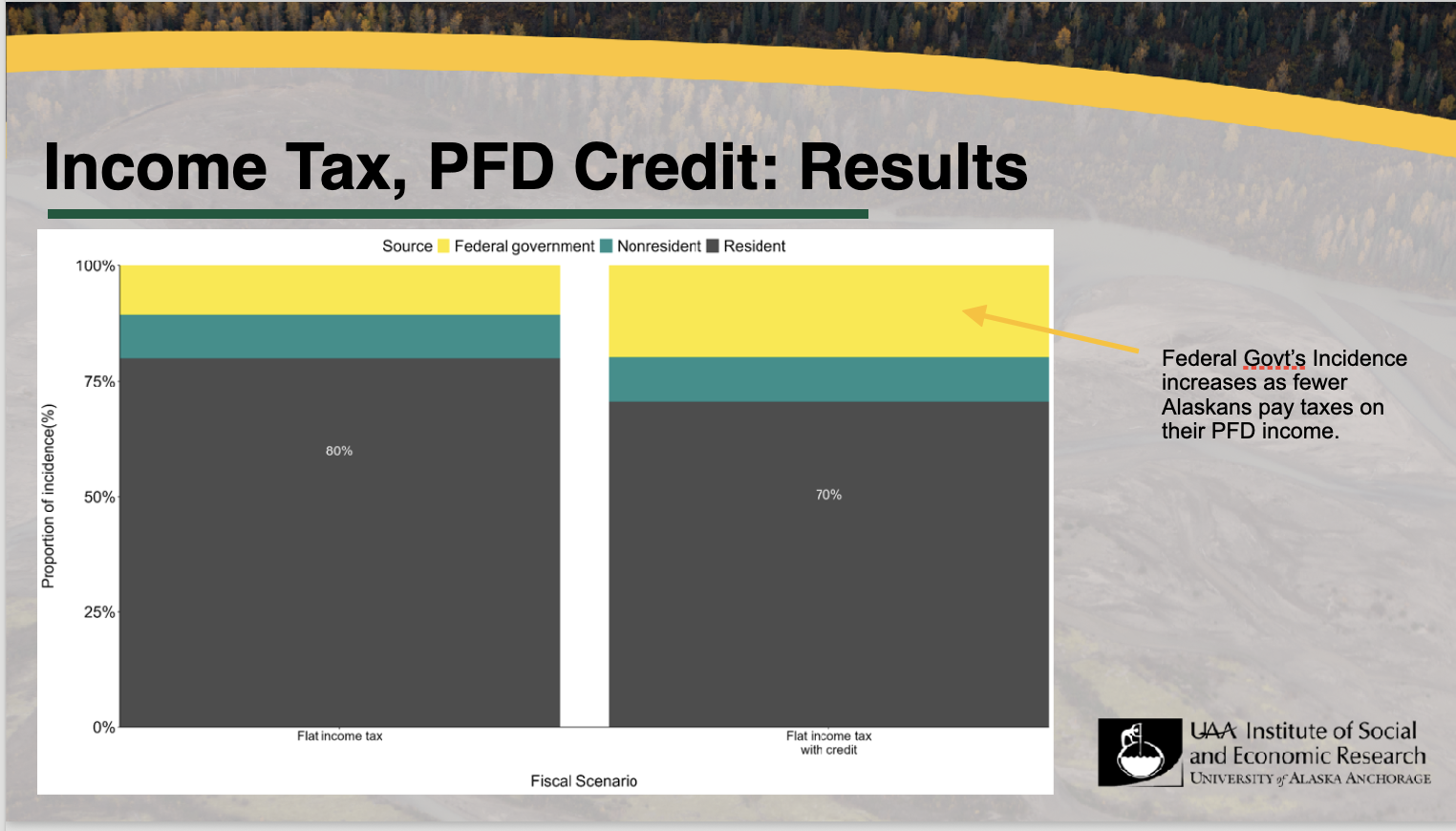

Alaska residents would pay 80 percent to 84 percent of a flat and progressive income tax, respectively.

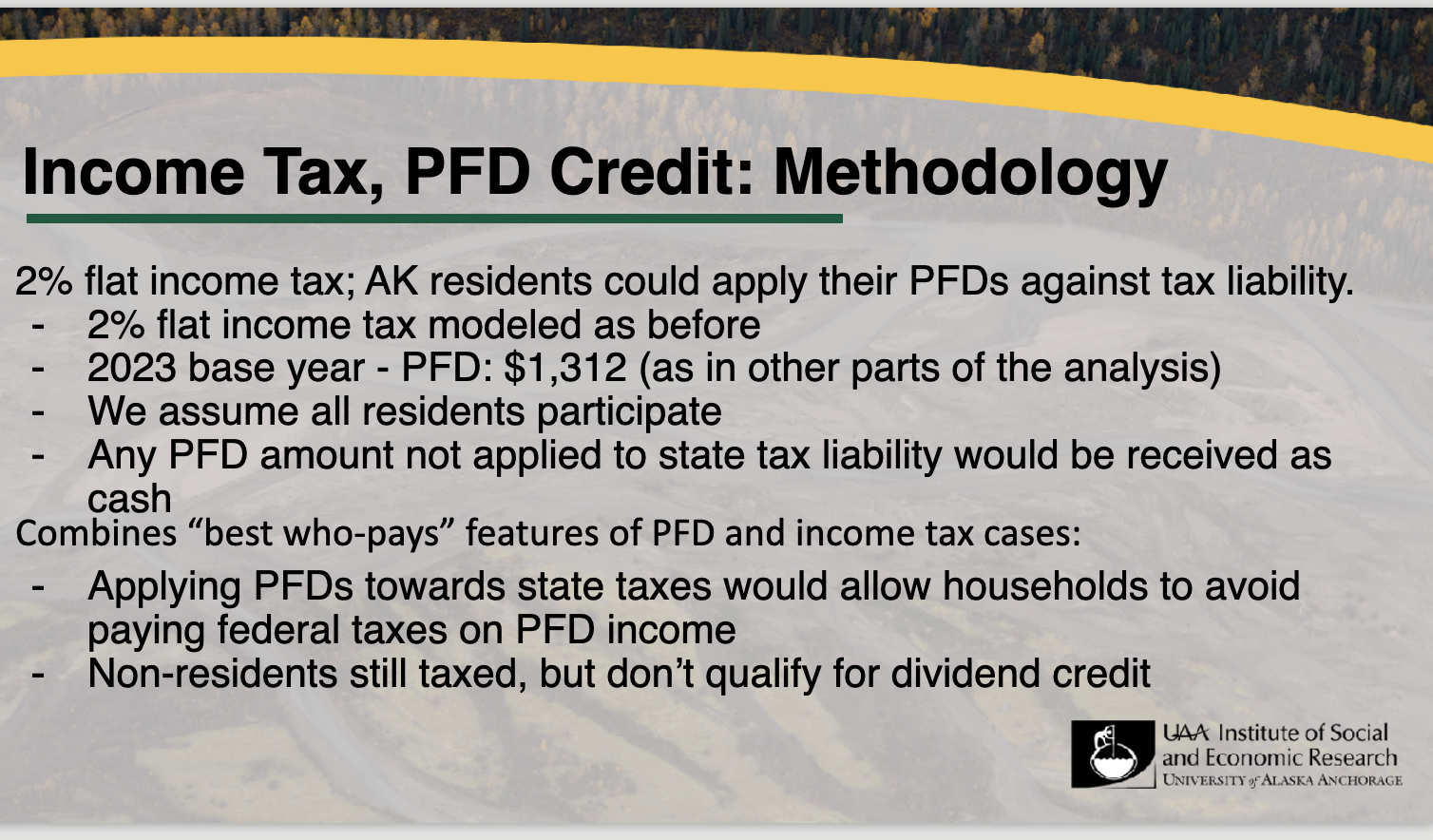

Personally, I think there is a lot to be said for an income tax and a PFD credit, which was one of the ideas that the late Gov. Jay Hammond spoke about incessantly 45 years ago.

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-0673.