Ambler mine promoter with 5 employees makes an overnight killing thanks to Trump

The Trump administration plans to siphon federal funds from the Pentagon to subsidize mining promotioni companies in the Ambler district, claiming the so-called “Department of War” will buy 10 percent of a Vancouver-based mining promoter and may offer loan guarantees as well.

The Pentagon will acquire a seat on the board of Trilogy Metals, one of two foreign companies that own Amber Metals LLC, a joint venture. The full amount of the Pentagon subsidy is unknown, as is what additional profits will be created for the billionaires and Outside institutions that own a majority of the Trilogy Metals stock.

“Under the terms of the agreement, the Department of War will acquire a 10 percent equity stake in Trilogy Metals, with options for increased ownership contingent upon the completion of key infrastructure, including the Ambler Access Road,” Ambler Metals says.

This is from the Wall Street Journal:

“Shares in Trilogy Metals (TMQ), a Vancouver mining company with five employees, roughly tripled in value in premarket trading. The surge came after Secretary of the Interior Doug Burgum said the U.S. would take a stake in Trilogy. The holding would total 10%, according to a White House fact sheet.”

The “fact sheet” does not contain key facts, such as why the Trump administration plans to give the mining promoter $35.6 million “to support mining exploration in Alaska’s Ambler mining district.”

“This investment makes the U.S. government a 10% shareholder in Trilogy Metals and includes warrants to purchase an additional 7.5% of the company,” the “fact sheet” says.

Ambler Metals is a joint venture between Trilogy of Vancouver and South32 of Australia. Ambler Metals calls itself a “team of Alaskans.”

It is not. Ambler Metals is owned by a company from Canada and a company from Australia.

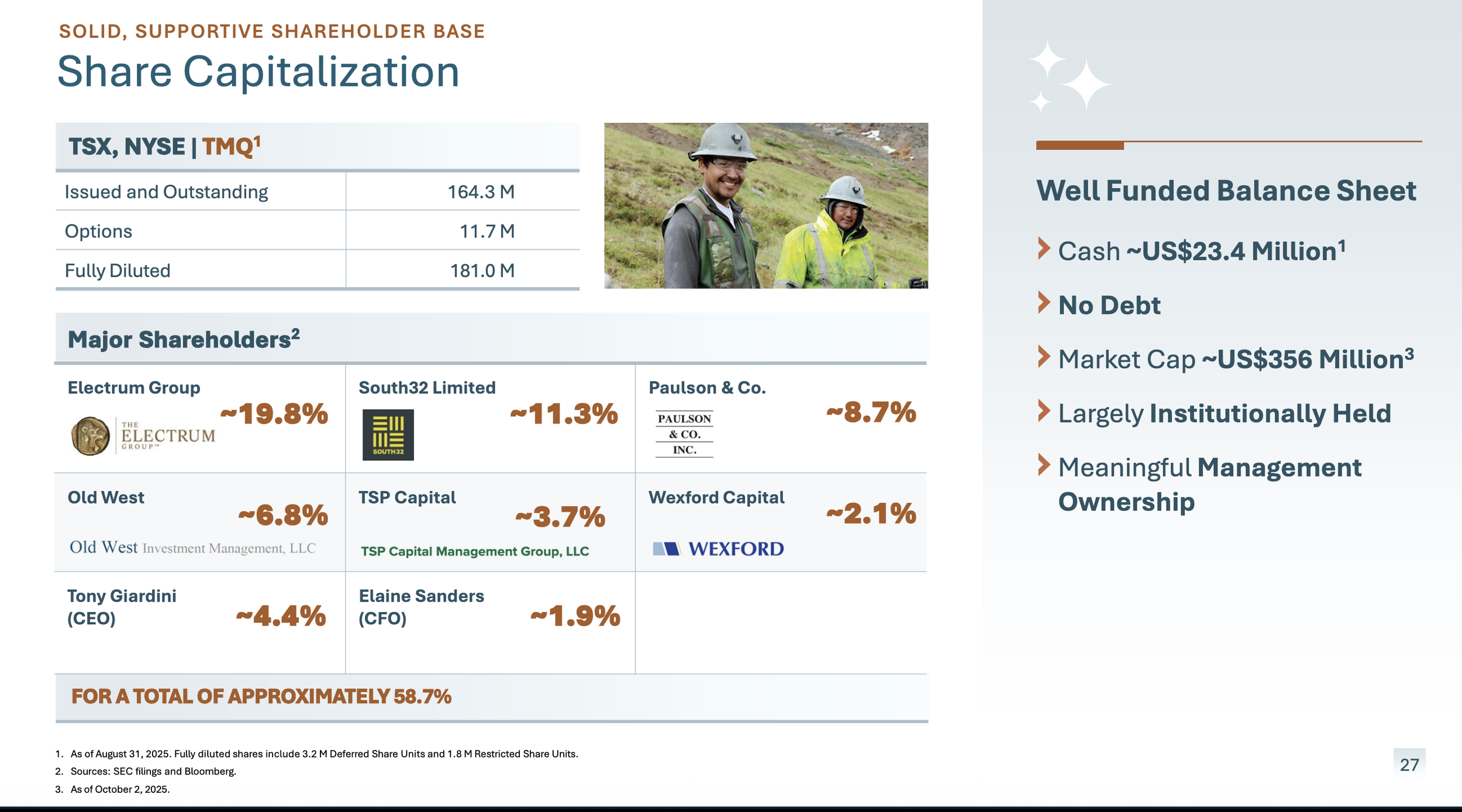

Here is the ownership structure.

While the Trump “fact sheet” does not mention the source of the $35.6 million, Ambler Metals says the Department of Defense will provide the cash. To please Trump, the company executives are not calling the defense department by its real name.

Ambler Metals claims the federal stake is a “landmark partnership with the U.S. Department of War.”

Also missing from the fact sheet is any explanation about why the federal government needs to own up to 17.5 percent of Trilogy to make this a going concern. The company presentations say this would be a highly profitable enterprise.

Buying part of the company is hardly free enterprise. It is an overnight windfall for Trilogy.

Another windfall for the owners of Trilogy will be the coming announcement from the Alaska Industrial Development & Export Authority that it will borrow money to build the Ambler road. That will make the company more valuable, whether it ever turns a shovel of dirt or not.

There will be a payback schedule of sorts under which AIDEA will claim that it will recoup the money to build the road over many decades through road tolls. But there is no agreement on that yet.

All this would make Trilogy an attractive target for a giant mining company to purchase its assets, which would benefit Trilogy’s stockholders.

“Trilogy Metals Inc is an exploration stage company engaged in mineral exploration,” a Morningstar stock analysis says.

“The company focuses on exploring and developing its mineral resource properties, which include the Upper Kobuk Mineral Projects (UKMP or UKMP Projects), in the Ambler mining district located in Alaska, the United States.”

One of Trilogy’s five employees is Tony Giardini, who is president, CEO and director. He owns 4.4 percent of the company.

Paulson is also a prime backer of the Donlin Mine.

As of the end of August, Trilogy reported cash holdings of $23.4 million.

Eight shareholders, most of them institutions, own nearly 60 percent of the company stock. The U.S. government would become one of the largest shareholders.

South32, the Australian company that owns half of Amber Metals, said it will sell $17.8 million of its Trilogy stock to the Department of Defense. It will keep 6.3 percent of its shares in the company.

“It will also issue a call option for the Defense Department to buy more shares in Trilogy from South32 once a controversial 211-mile access road to the minerals-rich Ambler region is built,” the Wall Street Journal said.

“South32’s 50% stake in the Ambler Metals joint venture isn’t affected by the deal.”

The board of Trilogy includes Willie Hensley and six others.

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-0673