Hensley, other insiders at Trilogy Metals, reap windfall profits from Trump's Ambler subsidy

Alaskan Willie Hensley, 84, and other insiders from Trilogy Metals, bought and sold shares at a big profit when the company’s stock skyrocketed with Donald Trump’s decision to subsidize the Canadian company.

“Willie Hensley, a former Alaska state representative, exercised an option to buy 100,000 shares for $1.81 each on Oct. 8 before selling the same number of shares for $6.39 each. Following the sale, he directly owned 43,638 shares valued at $369,177,” Barron’s reported Thusday.

Hensley sold 100,000 shares the same day he bought them, making more than $400,000 on those transactions, according to a document filed with the Securities and Exchange Commission.

No one is suggesting that Hensley did anything illegal. He is a board member of Trilogy Metals, which owns half of Ambler Metals LLC.

Trilogy Metals had been selling at a little more than $2 a share before Trump said he would use Department of Defense money to buy 10 percent of the company on Oct. 6. The stock quickly jumped by several dollars a share.

Hensley and other insiders exercised options to buy shares at a low price and sell them at the new higher market price on the same day.

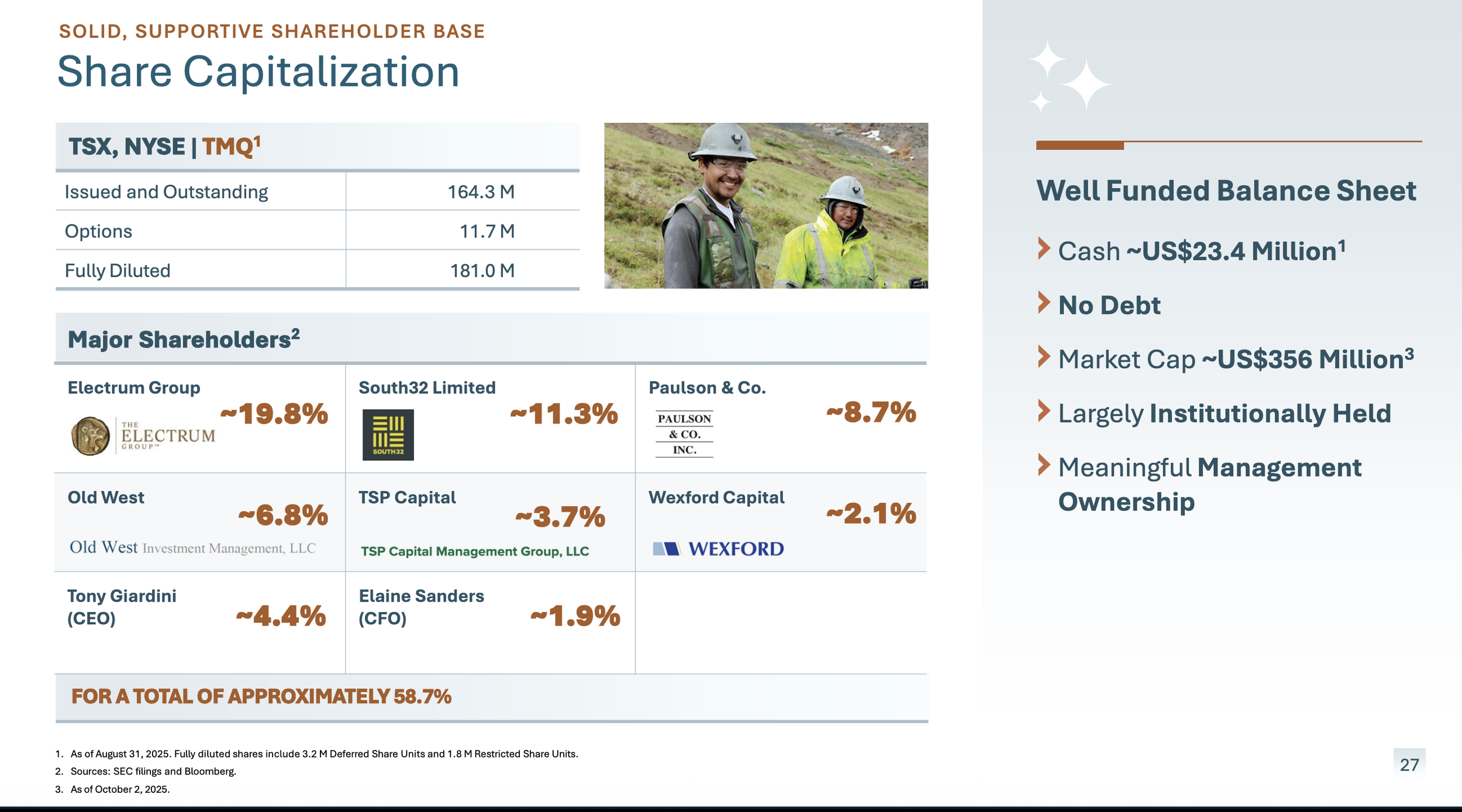

Elaine Sanders, the chief financial officer and vice president of the company, exercised options to buy 450,000 shares at $1.81 a share, a purchase valued at more than $800,000. She sold the shares the same day, collecting a profit of about $2 million.

Sanders retains more than 3 million shares of the company, about two percent of the company. Her holdings are worth close to $20 million, up from about $6 million a month ago.

“I’m very personally a large shareholder at Trilogy,” Sanders told an interviewer five years ago.

“I’ve been personally invested in this project for many, many years. We really believed when we put this project together that this was going to be a district exploration play that we were looking at mining for generations to come in the communities. We weren’t planning on just being there for a short period of time and then leaving. What we really wanted to do was build long-term relationships, mining for generations in this area, and to have a long lasting effect for the people that lived up there.”

“And so I’m all in. I know Rick (Van Nieuwenhuyse) is a very large shareholder. He’s all in, and we have large institutional shareholders that have been there with us since we were at the NOVAGOLD days. That’s Electrum out of New York, Paulson and Company out of New York, the Baupost Group out of Boston. Those three large shareholders have been with us since the spin-out from NOVAGOLD and they have always been longterm fans of this district, so they haven’t sold a single share and have accumulated over the years. So very supportive shareholders as well, so very exciting times. A very exciting company to be working at right now.”

Gregory Lang, the CEO of NovaGold Resources, sold about 200,000 shares over two days, Oct. 8-9. He gave the inflated proceeds from 30,000 shares to a charity. He bought 50,000 shares Oct. 9 at $1.81 and sold them the same day at $6.53, along with about 120,000 other shares. He retains 252,000 shares through a family trust.

Diana Walters, former president of Liberty Metals and Mining, another board member, exercised an option to buy 100,000 shares for $1.81 each and sold them the same day for $7.03.

“Two other company directors, Janice Stairs and Hayden Beckwith, sold a combined 484,088 shares for $2.1 million between Oct. 8 and Oct. 9,” Barron’s said.

Board member James Gowans, bought 100,000 shares Thursday at $1.79 a share and sold them the same day for $7.50 a share, earning more than $550.000 with the transactions.

The Department of Defense, which Trump calls the war department, agreed to pay Trilogy $17.8 million and South32 $17.8 million. Trilogy had $25 million in cash on hand a year ago and had reduced the size of its payroll.

The defense department has promised to “facilitate financing” for the Ambler road. The Alaska Industrial Development and Export Authority has not released details of its financing plan for the road.

The major stockholders in Trilogy Metals are institutions, led by the Electrum Group, which owns about 20 percent of the company; South32 Limited, which owns 11 percent; and Paulson & Co., which owns 9 percent.

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-067