Part of the SB 21 tax bill that appeared out of nowhere costs Alaska hundreds of millions

In enacting the SB 21 oil tax law in 2013, the Legislature and former Gov. Sean Parnell said it contained a fixed 35 percent tax. It was simple, Parnell said.

"Gone are the days of complicated, ever-changing monthly tax-rate calculations. Alaska’s oil tax system will now be built around a 35 percent base rate and tax incentives tied directly to new oil production," Parnell said nearly nine years ago when he signed SB 21. "In other words - oil producers, if you want the tax incentives, there is no 'try,' there is only 'do.' Get that oil flowing."

But it was not that simple. It still isn’t. The SB 21 tax has never been close to 35 percent.

Parnell gave a misleading description of one of the main tax incentives in the law he took to calling the More Alaska Production Act, a name created after the bill became law.

The law offers the oil companies a per barrel credit that peaks at $8 per barrel when oil is near $90 a barrel on the West Coast and drops to zero when oil is $160 per barrel. This credit reduces the tax rate, with the greatest reduction at prices we are now seeing, close to $100 a barrel.

The tax break it creates is on the legacy oil fields that did not qualify for “new oil” incentives, but where costs are lower and facilities have long been in place.

The $8 credit means that the 35 percent “fixed tax rate” would only apply if oil ever reaches $160 a barrel.

In December, based on oil at $75 a barrel, the state predicted the per barrel credits would cost the state $1.3 billion this fiscal year and $1.25 billion next fiscal year. With higher prices, those numbers would be hundreds of millions higher.

One of the enduring mysteries of SB 21 is that no one has ever said said exactly where the $8 credit plan came from or justified the choice of that number. The sliding scale appeared as if by magic in a committee bill on March 29, 2013.

It was probably the work of the oil industry in consultation with state consultants, Parnell’s revenue department and GOP legislators who wanted to cut oil taxes. The $8 credit emerged in the version of the bill offered by the resources committee, chaired by Republican Reps. Eric Feige and Dan Saddler.

Feige is the husband of Corri Feige, now the state resources commissioner, while Saddler, longtime government employee, is running for the Legislature again in Anchorage.

On March 27, 2013, the bill still contained a $5 per barrel credit. The oil companies kind of liked the idea, depending upon how it would be applied, but some wanted more than $5.

There was no mention of the $8 credit during a March 28, 2013 hearing on the tax bill, at which Revenue Commissioner Bryan Butcher and Natural Resources Commissioner Dan Sullivan talked about the plan. On that date, it was still a $5 per barrel credit.

There was a detailed discussion about the $5 plan. There was even a bit of a dispute about how companies qualified for the $5 credit with Homer Rep. Paul Seaton.

When Seaton questioned why the administration wasn’t proposing a credit plan that rewarded companies for additional production and penalized them for reductions, instead of giving credits in all existing fields, Butcher said that would be too complicated.

On the afternoon of March 29, 2013, the $5 credit turned into an $8 credit.

The new $8 credit plan appeared with no detailed analysis about its impact, but with some long-winded explanations.

Seaton said the impact of the credit was to significantly lower the tax rate when prices fell below $110.

The committee adopted the measure with the $8 sliding-scale credit on April 4, 2013, ten days before the Legislature approved SB 21.

There was never any real vetting of the $8 credit.

Janek Mayer and Nikos Tsafos, partners in the consulting company Enalytica, told lawmakers in 2015 that the per-barrel tax credit should be thought of as a way to lower the tax rate when oil prices were below $160. The consultants referred to the credit as a "mild form of reverse progressivity," meaning that the tax would be lower at $90 when the credit is highest.

"Thinking about it as a credit in terms of money that's somehow being handed back to companies is incorrect. This is simply a feature of the tax system that is intentionally designed to reduce the tax level at lower oil prices," said Mayer.

Mayer was incorrect.

It should be thought of as a credit because it is a credit in state law, one the companies collect in the form of paying a great deal less in production taxes than they would without the credit.

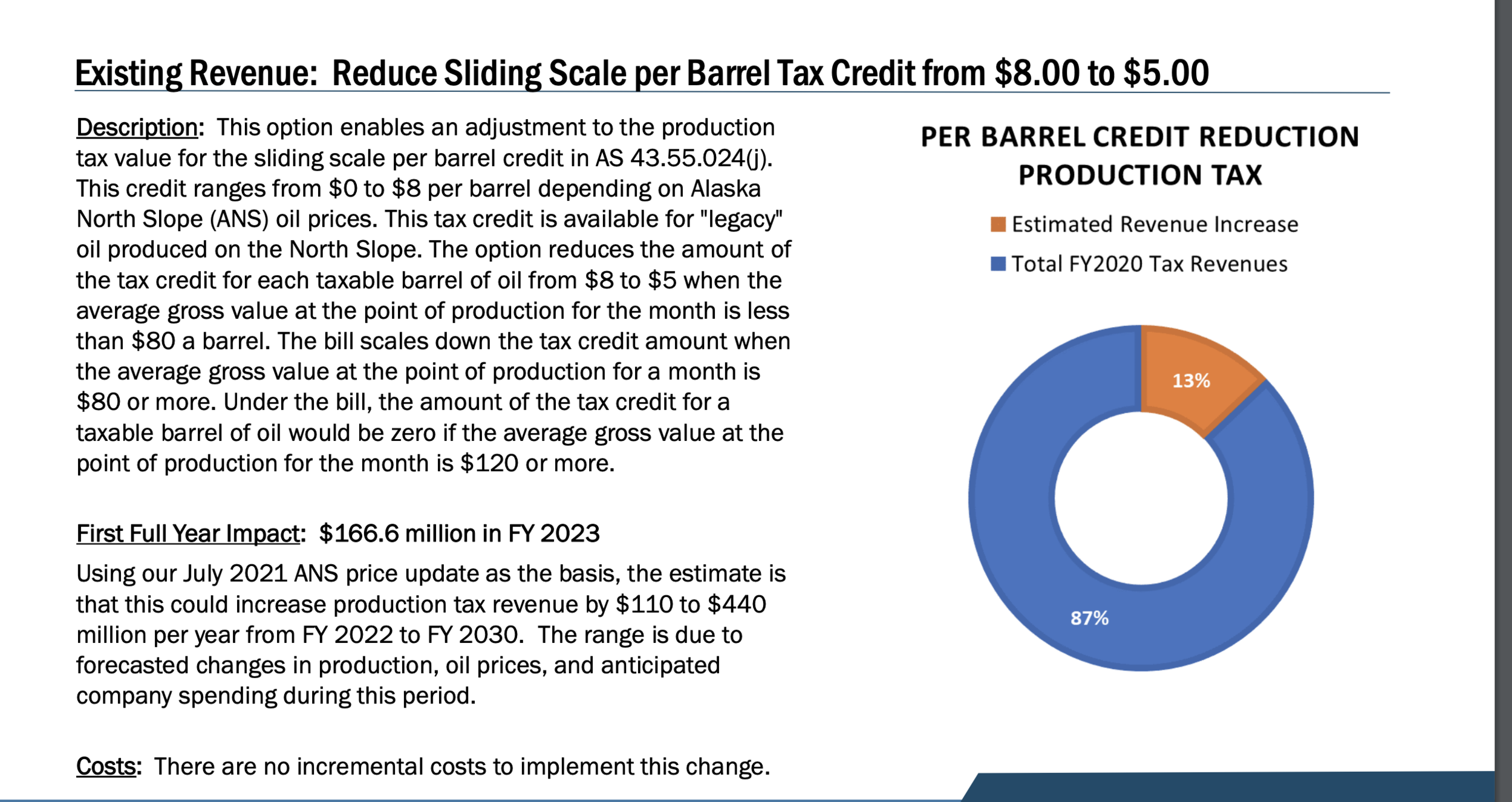

Last summer, before the spike in oil prices temporarily eased state budget problems, Gov. Mike Dunleavy allowed his revenue commissioner to present the slide below to legislators about what would happen if the credit were reduced to $5.

The impact of cutting the credit to $5 a barrel would be hundreds of millions higher if oil prices remain near $100 a barrel.

Dunleavy and his revenue commissioner don’t support cutting credits, but the $5 plan would be a good place for the Legislature to start. At the very least, we deserve to know why even Dunleavy thought it was OK to mention cutting credits.

With current oil prices we are paying close to the maximum in per barrel credits to the oil industry, a billion-dollar-plus scheme that has never been vetted or justified. It's way past time to do something about that.

Your contributions help support independent analysis and political commentary by Alaska reporter and author Dermot Cole. Thank you for reading and for your support. Either click here to use PayPal or send checks to: Dermot Cole, Box 10673, Fairbanks, AK 99710-0673.